There are two very distinct approaches to financial success that may be pursued in the financial sector. The first strategy is to purchase stocks and then keep them for an extended period of time, with the goal of increasing one’s income via dividends as well as the amount of money one possesses as a result of rising market prices.

The second strategy is to engage in short-term trades based on technical analysis in an effort to capitalize on the price volatility, also known as uptrends and downtrends, that is observed in stock markets.

Traders that are successful in the short term make use of a variety of instruments that can produce trading signals based on the information contained in price charts. The majority of the tools, as well as technical indicators available to traders, only provide a fragmented representation of the full picture.

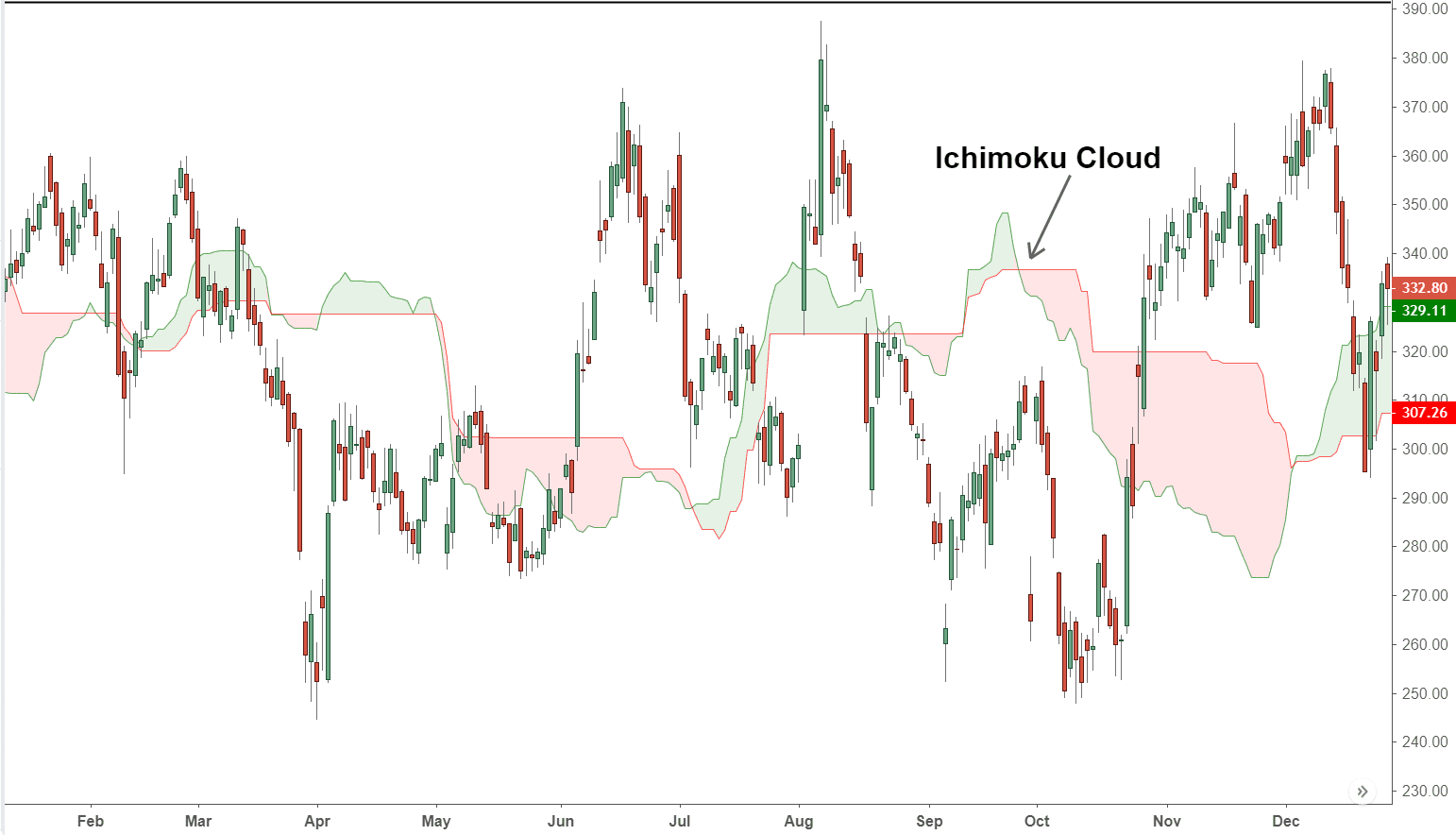

Throughout the course of our time as traders, the Ichimoku Cloud has consistently shown to be one of the most accurate and effective indicators we have utilized. It is a widespread (and free) indicator that can be located on the majority of trading platforms. It depicts a grey “cloud” that integrates many points of data to provide a current and future forecast of support as well as resistance. On the chart that follows, you’ll see an example of what the Ichimoku Cloud looks like when it’s plotted.

The Ichimoku Cloud: What Role Does It Play?

Within the Ichimoku Cloud, there are three different parameters that may be altered when going for Ichimoku trading–

Tenkan-sen Calculation

Calculation of something like the Tenkan-sen (the average of the high for the nine periods plus the average of the low for the nine times) divided by 2. This contributes to the formation of the cloud’s outline. Whenever the stock price is trending higher, the moving average line tends to form the top of something like the cloud’s shape. This is because the moving average line consists of 9 periods.

Senkou Span B Calculation

The calculation for the Senkou Span B is as follows: (the average of the high for the 52 periods plus the average of the low for the 52 periods) / 2. This is the moving average that has been calculated for a longer period of time, and it forms some other side of the cloud shape. This indicates that the upper half of the cloud is formed while the price is declining, and it does so as a result of this.

Kijun-sen Baseline or Standard Period

Kijun-sen Baseline or Standard Period = (the average of the high for the previous 26 periods plus the average of the low for the previous 26 periods) / 2. Updating this indication gives you the ability to modify the offset of something like the indicator in the future, allowing you to move it either backward or forwards. This is a very handy feature.

After you’ve plotted cloud on the chart of such commodity you’re trading, here are some important things to bear in mind:

Whenever prices go below the Ichimoku Cloud, this indicates that a downward tendency is present in the market. Alternately, prices that are a little over the Cloud indicate that an upward tendency is present in the market. Bear in mind that there is the potential for a time with no discernible trend, during which the price remains constant inside the Cloud. It is recommended that when you are in this area, you should not take any positions at all since this region is classified as a noisy zone.

If the Senkou Span A moves higher and then crosses back over the Senkou Span B, this indicates that there is an increasing amount of bullish decisions within the market. This is a purchase indication; thus, you should proceed. Bearish momentum is indicated when the Senkou Span A is moving in a downward direction and then when it falls below the Senkou Span B. But on the other hand, bullish momentum is shown when the Senkou Span B is above it. In most cases, it is called a sell signal.

A purchase signal is generated when the asset price, the Tenkan-sen (Conversion line), along with the indication of Kijun-sen (Baseline) are all located above the Cloud as well as the Tenkan-sen exceeds the Kijun-sen (Baseline) from above. Once the Tenkan-sen (Conversion line), along with the Kijun-sen (Baseline), and the value are all located much lower than the Cloud, this indicates that the market is moving in the other direction.

Conclusion

With proper information and understanding of the Ichimoku cloud, investors can make profitable decisions.